According to a report on FinTech by KMPG, the transaction value for the Indian FinTech sector is anticipated to be approximately $33 billion in 2016 and is expected to reach $73 billion in 2020. The growth in smart phones and consumers’ willingness to transact online has spawned a large number of start-ups, who are trying to take advantage of this opportunity.

Here are a few other FinTech Startups from India that were showcased in the Mint FinTech Summit 2016:

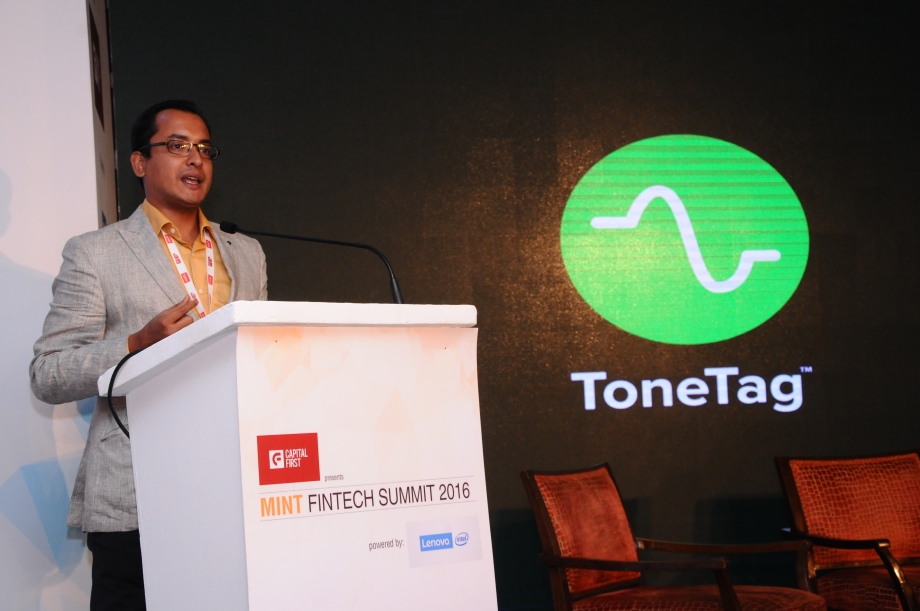

- ToneTag (Naffa Innovations Pvt Ltd)

ToneTag from the year 2013 provides an app that enables contactless payments on any device, bringing an Apple Pay like experience to millions of Indians, without having to add any infrastructure. This is by done using sound waves to enable proximity-based payments. ToneTag talks to a merchant’s point-of-sale system using encrypted sound waves, and works even with background noise. The system works well, even without mobile Internet. ToneTag offers a patent-pending software development kit that can be integrated into applications that would either accept payments based on tone, or based on near-field communication depending on the merchant.

- Unocoin (Unocoin Technologies Pvt. Ltd)

Unocoin founded in the year 2013, operates a Bitcoin wallet that Indian users can use to sign up and buy or sell bitcoins. Unocoin has partnered with various companies around the world such as BTCjam, a peer-to-peer lending marketplace using bitcoins, and Purse, which helps translate Amazon gift card balances to bitcoin and rupees. It has also partnered with wallet provider MobiKwik and lets its users transact on MobiKwik with the help of bitcoins. It even launched a point-of-sale app for merchants to accept money through bitcoins.

- SayPay Technologies Inc

SayPay Technologies, founded in 2013 is a biometric authentication provider that works on identifying customers uniquely based on biometrics like sound. SayPay Technologies users speak a one-time code instead of a password which is much more secure than the one-time-passwords that are in use. An entire transaction can be completed in seven seconds. The start-up, which has filed a patent for this technology, has partnered with two banks and is looking to partner with more. It says it can be extended to most financial transactions, including consumer bill payments, e-commerce, payment gateway integration, step-up authentication, P2P (peer-to-peer) transfers and corporate payment approvals. It works with both, feature phones as well as smartphones.

- Scripbox (Scripbox.com India Pvt. Ltd)

Scripbox started in the year 2012, offers an online mutual funds investment platform for individuals. When they sign up, individuals can decide how much they want to invest— be it monthly or long-term—in equities, debt fund and tax-savings fund or equity linked savings scheme. The funds presented to the users are chosen by algorithms and have no manual intervention. Scripbox doesn’t charge users but makes money by getting a distributor commission from asset management companies. However, it doesn’t have any tie-ups with them and takes the commission they hand out.

- Senseforth (Senseforth Technologies Pvt. Ltd)

Senseforth started in 2012, offers an artificial intelligence platform that can offer all the services of a bank has over chat. The platform, called A.ware, has been bench-marked against various industry standards, and the start-up claims it performs better in most respects. Senseforth has at least 12 different bots that are capable to perform functions as varied as evaluating risks facing businesses and providing alerts to avoid adverse impact. It even helps the businesses comply with regulations, standards and governance-related issues, one that surfaces a business’ products and services where needed, as well as structuring personalized portfolios to your customers and advises on investment opportunities. It works with clients such as HDFC Bank Ltd and T-Mobile International AG.

Watch the events’ webcast where experts discussed on ‘Regulations that make it conducive for FinTech’ at Mint FinTech presented by Capital First which took place on 30th June, 2016 in Bangalore.

Know about the other startups showcased at Mint FinTech Summit 2016 by clicking at the following link:

https://minteventsblog.wordpress.com/2016/07/12/indias-fintech-revolution-emerging-fintech-startups/

One thought on “India’s FinTech Revolution: Emerging FinTech Startups”